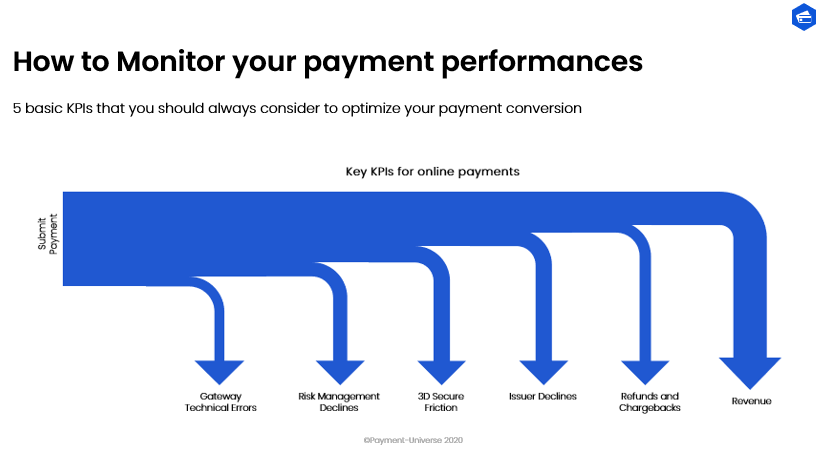

How to Monitor your payment performances. 5 KPIs that you should consider to optimize your payment performances.

There are several components playing a fundamental role in achieving successful results for businesses that want to sell online. Obviously having attractive and valuable products or services, a good marketing campaign, and efficient processes are key elements for any business. But at the end of the day, the main goal for any online business is to have the best possible conversion rate, and to achieve this you need good payment performances. Therefore, offering the right payment methods with a smooth customer experience is the final ring of the chain to ensure success.

To ensure that you are accepting payments in the right way, it is essential to monitor the correct Key Performance Indicators which will give you an indication of your payment acceptance “health level”.

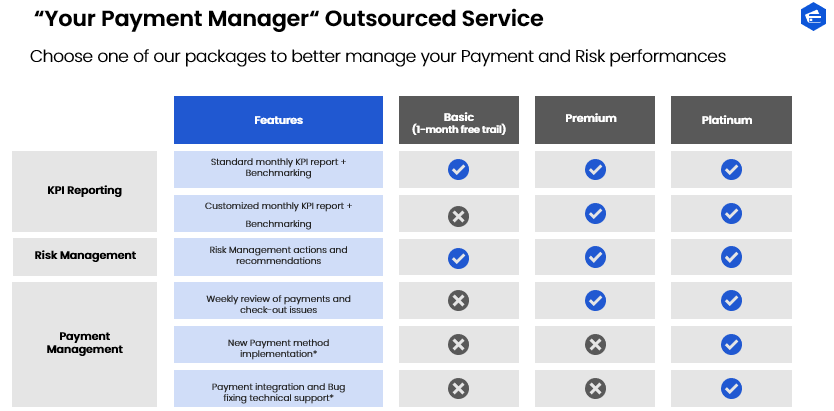

At Payment Universe, we are offering a new service to outsource payment management to assist online merchants in monitoring, analyzing, and improving payment performances. The aim of “Your Payment Manager” is to help merchants increase their conversion rate and revenue by just leveraging better payment management. Just a few percent increases in the conversion rate can have a huge impact on your revenue. We offer a 1-month free trial for this service. Just contact us!

Based on years of experience in optimizing merchants’ online payments, we are sharing below 5 basic Payment KPIs to establish a performing payment monitoring framework.

In general, It is always recommendable to calculate KPIs on the transaction level and on the customer level. The two might show completely different pictures, and the second one could be more accurate in some cases.

- Acceptance Rate

First, it Is important to understand how many orders do actually end up as a successful purchase. There are different factors that can affect this KPI, but this is the value that is constantly monitored to see if your payments are not facing too many declines.

This KPI should be analyzed in detail considering several data points (i.e. payment types, market locations, etc.) to have a more comprehensive overview of possible areas of improvement.

- Issuer declines

Not all issuer declines mean the same. An increase in decline reason codes such as ‘Stolen Card’ or ‘Suspected Fraud’ might indicate that your risk management setup is not tailored to your business anymore, as you let go through too many transactions which are after recognized as fraudulent by the issuer.

With the PSD2 Strong Customer Authentication (SCA) and the migration plans brought by some local regulators, it is extremely important to keep an eye as well on ‘Soft Declines’. If you are not sending your full traffic with 3D authentications you should start to see this reason code appearing more often in some specific markets.

There are plenty of other reason codes that can bring valuable indicators depending on merchant different business models. A high number of ‘Expired Cards’ for a business that is focused on recurring payment models (i.e. subscription), might be a high indicator that solutions such as Automated Billing Updater or EMV Tokenization should be worth considering.

- Strong Customer Authentication – 3DS Attrition

It is not a secret that 3D Secure has been considered by many as a conversion killer in some markets (i.e. Germany or Italy). That’s the reason why, over the years, merchants have been implementing several 3DS dynamic logics to decide when to request 3DS secure based on transaction risk profile. With PSD2 SCA regulation coming into force in EU, 3DS secure becomes mandatory and using the enhanced EMV 3DS seems fundamental to maintain good performances. 3 factors can contribute to the 3DS attrition:

- Failed authentications – Happens when the consumer fails to authenticate (i.e. wrong password).

- Session abandonment – Happens when the consumer cannot authenticate and decides to abort the session

- MPI/ 3DS Server technical failures- Related to technical errors coming during the technical redirection or authentication flow. Especially with the implementation of 3DS2 it is a key KPI to keep an eye on as the protocol brings different conditions related to data format.

If you want to learn more about the PSD2 impact on payments, download our free SCA starter guide.

- Fraud and Chargeback rates

In our experience, we have always preferred to distinguish between those 2 KPIs. A fraudulent transaction does not always result into a fraudulent chargeback (i.e. transactions which have 3DS liability shift on the issuer are almost never reported as chargebacks). Monitoring the development of your fraud rates is essential to ensure that you stay away from card schemes monitoring programs. This should be done considering deep analysis based on your data points, building an automated and straightforward reporting framework (we, at Payment Universe, can assist you in the process). Beside post-factum reporting, it is key for your fraud prevention teams to generate reporting about your real-time decisioning, checking how many transactions your fraud prevention tool is declining (a spike in this value might actual mean that a new fraud attack is taking place or that simply your setup is producing too many false declines).

When it comes to chargebacks it is not only important to know what your current ratio is and how many are coming every month, but it is also strongly recommended to monitor and analyze your performances in disputing them. We have seen many merchants not correctly disputing chargebacks and/or in some cases not disputing them at all! A surge in specific chargeback codes might be an indicator that some of your processes need improvements (i.e. reason codes such as service or goods not received could be prevented by an efficient customer service)

- Gateway technical errors

There is no business which would like to experience gateway technical errors but, unfortunately, it is common for those to appear as well. Nevertheless, not all those errors are gateway’s “fault”, in many cases those can be caused by wrong API implementations, some new integration enhancements, wrong data inputs and so on. Keeping an eye on those can help you to increase your payment overall acceptance rate.

To learn more about how “Your Payment Manager” works and to improve your current Payment performances contact us.