ChatGPT and the digital payments challenge . Part 1.

ChatGPT has massively shacked the tech industry over the last few weeks and during the last few days, we had the amazing idea to try to challenge it with the topics that we handle on daily basis and we have been working over the last decade in payments.

This is part 1 of our “challenge”, where we wanted to test some basic payment knowledge to see if payment consultants should risk being out of jobs very soon. we can already say that, in our personal opinion, ChatGPT has still to “learn” a lot about digital payments.

Below are 10 questions we asked ChatGPT related to digital payments.

1. What does ChatGPT think about digital payments?

Starting from some very basic questions, we were curious to see what ChatGPT would tell us about digital payments. ChatGPT provides a disclaimer about the fact that it doesn’t have personal opinions or emotions and that according to its point of view, there is a need for appropriate regulations in the payments industry.

Vote: 8/10. The question was very general and many things could have been said.

2. What is a payment gateway?

We wanted to test a few basic definitions related to payment terminologies, such a question should be quite straightforward and easy to answer considering the amount of available information. I would say that ChatGPT was precise with this reply, specifying that the traditional payment gateway behaves as an intermediary and should be associated with the acquiring bank or processor, even though often a payment gateway has an acquiring license.

Vote: 10/10. The question was general but the reply was straight to the point.

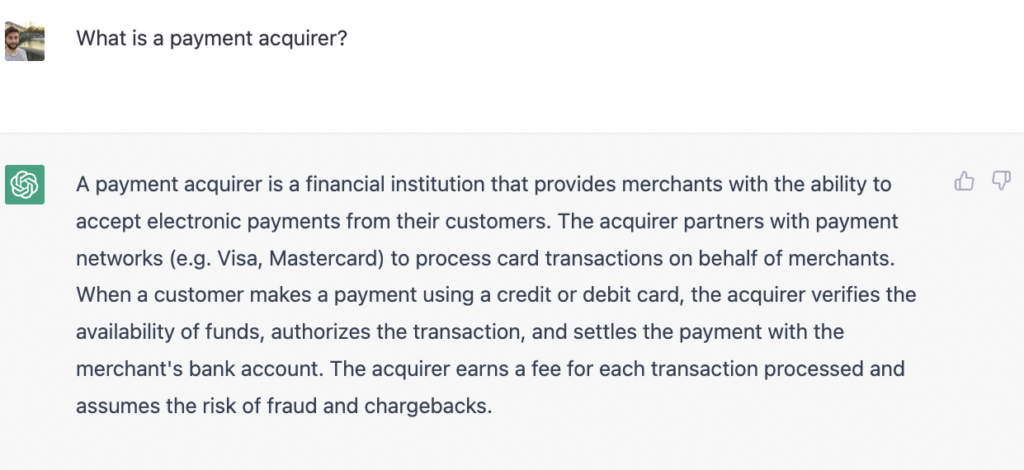

3. What is a payment acquirer?

Now we wanted to see if ChatGPT would correctly differentiate between the payment gateway and the payment acquirer definitions, considering the previous answer where acquiring bank and processor were mentioned. The answer was once again very precise and we would consider it a good and clear one, including the right amount of information to explain to anybody what a payment acquirer is.

Vote: 10/10. The question was general but the reply was straight to the point.

4. What are the 10 best payment service providers to accept payments online?

We asked ChatGPT for a list of the 10 best payment service providers to accept online payments. To such a general question many different answers can be provided and that’s precisely why we were very curious to see what ChatGPT would say. Overall mentioning PayPal, Adyen, Stripe or Square should be expected, while not mentioning companies such as Chase, Worldpay, Wordline or Cybersource was a bit of a disappointment. Can Skrill or Amazon Payments be even considered PSPs?

Vote 6/10. It could have been better.

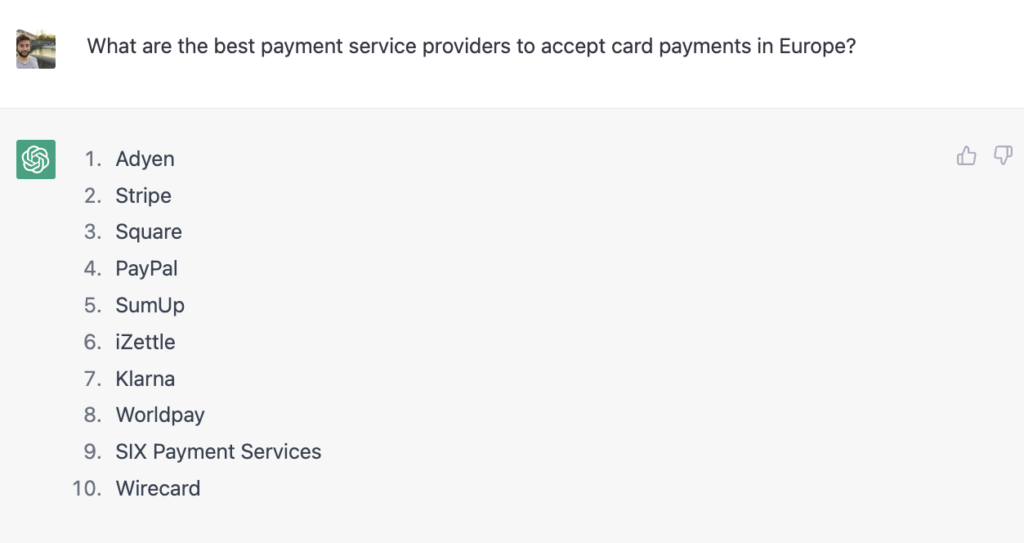

5. What are the best payment service providers to accept card payments in Europe?

Probably we had to help ChatGPT a bit and give more precise information about the payment method type (cards) and the geography (Europe) of our scope. The answer was interesting as now we got companies such as SumUp and iZettle, more focused on card-present payments for SMEs in Europe, Worldpay, Klarna and SIX Payment Services, but no Worldline or Nexi, and surprisingly we got Wirecard as an answer. Maybe ChatGPT wanted to joke a bit with us…

Vote: 7/10. Maybe if asked a couple of years ago we could have given an extra point.

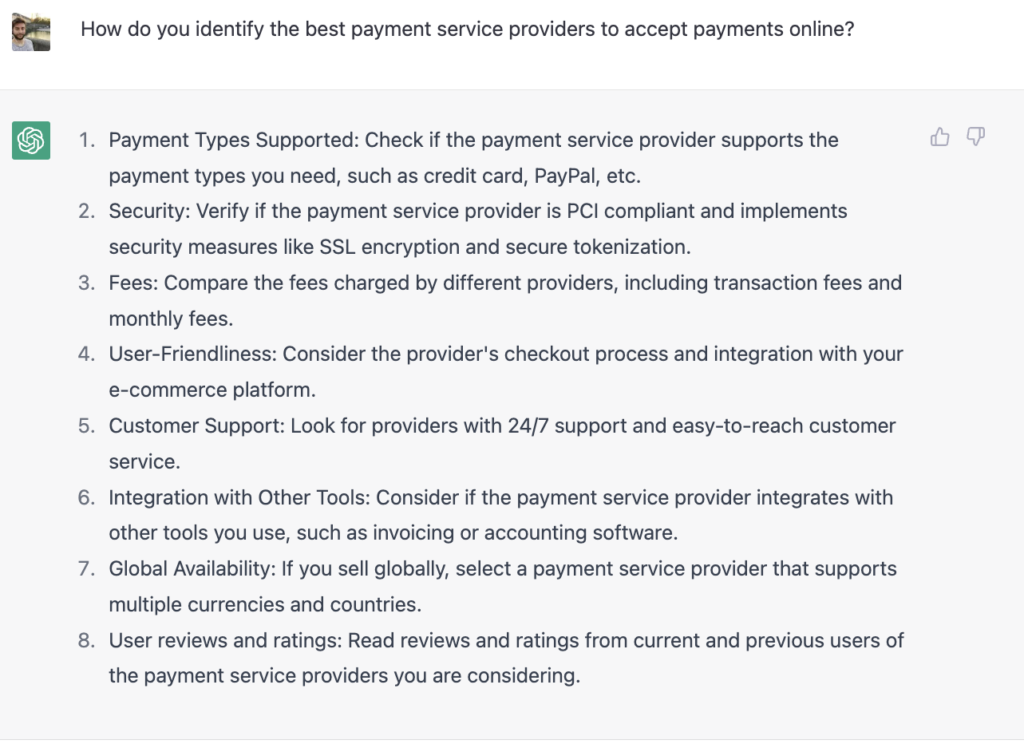

6. How do you identify the best payment service providers to accept payments online?

Ok, we got some provider names from ChatGPT but what are the criteria to identify the best payment service providers according to it? Overall we would say that the answer was good and acceptable as the ones provided can be considered part of the main aspects to look at, even though enterprise merchants would have some extra requirements related to features or specific payment processing use cases.

Vote: 8/10. It was a good starting list.

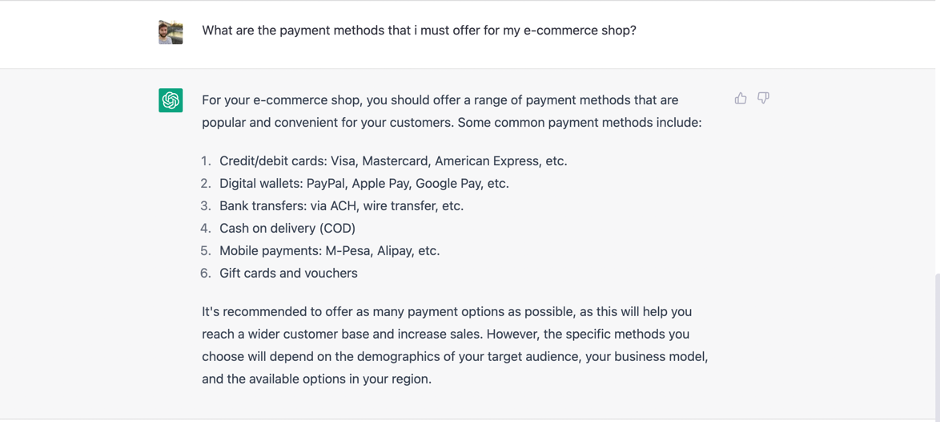

7. What are the payment methods that I must offer for my e-commerce shop?

We wanted to check what ChatGPT would say about the payment methods that e-commerce merchants should offer. We would have expected a bit of more detailed information and we were quite surprised that there was no mention of Payment on Invoice, Buy now pay later or any kind of lending product.

Vote: 5/10. Surely somebody should remind ChatGPT that BNPL is a quite popular payment method.

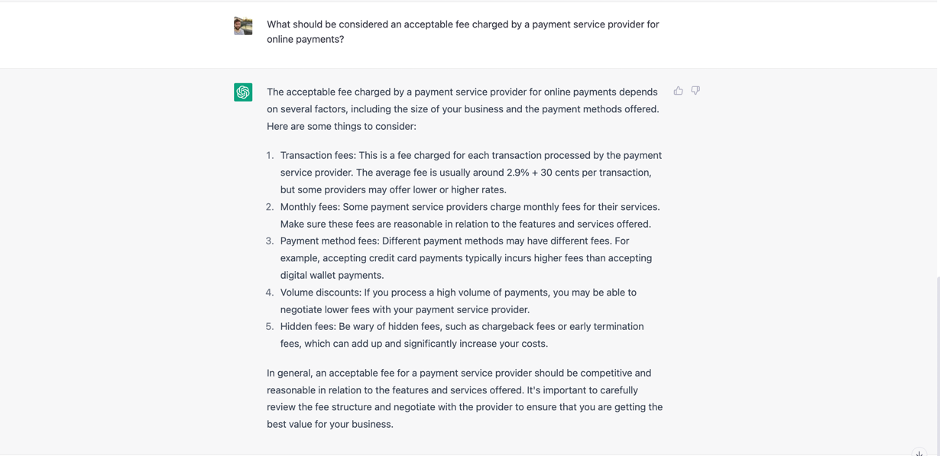

8. What should be considered an acceptable fee charged by a payment service provider for online payments?

What about payment fees and what should be considered an acceptable fee to offer digital payments? According to ChatGPT the average fee is 2.9% + 30 cents per transaction, a bit expensive in our opinion. Surely some important factors and aspects were mentioned but we asked about an acceptable number we did not receive.

Vote: 6/10. Maybe next time, some sources behind the numbers would have been better.

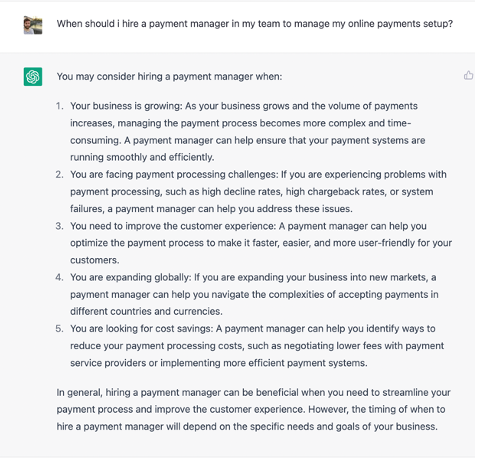

9. When should I hire a payment manager in my team to manage my online payments setup?

The right time to hire a payment manager is a tricky topic for many companies. Very often we engage with companies where payments are being managed by somebody in treasury or working with accounting.

Vote 10/10. The answer we got was quite good and surprisingly right!

10. Is it worth it for my business to hire an external consultant to support online digital payment topics?

If you arrived at question n.10 it probably means that in the next 24 hours, you will go to https://openai.com/blog/chatgpt/ and start asking for some other related payments!

As a closing question, we have thought to ask ChatGPT when it is worth hiring external consultants like the one we have in our team of payment experts.

We agree with ChatGPT that it depends on the level of expertise, time availability and much more. We missed maybe the fact that external consultants can speed up projects in many cases or are faster to find and commit to compared to hiring full-time and long-term employees.

Vote: 9/10. It was a good one.

At Payment-Universe we are a team of payments experts that support fintech and merchants with payment acceptance, acquiring, issuing, risk, open banking and many other topics in fixed-term projects and vendor selection processes. Contact us today for a free introductory call.